In response to ongoing requests by plan sponsors, service providers and industry associations alike, the Department of Labor (DOL) issued informal, legally nonbinding guidance earlier this year to help address issues surrounding missing retirement plan participants. Join members of Faegre Drinker’s benefits and executive compensation group on April 14 from 11:00 – Noon CT, as we explore best practices for plan sponsors to identify missing and nonresponsive plan participants, as well as potential approaches to facilitate compliance and mitigate risk of penalties.

Category: Retirement Plans

Reminder: The SECURE Act’s Safe Harbor for Lifetime Annuity Options Opens New Possibilities for Defined Contribution Plan Sponsors

The Setting Every Community Up for Retirement Enhancement (“SECURE”) Act made a number of changes designed to increase the availability of lifetime income options in defined contribution retirement plans, such as 401(k) plans. Among those changes was a new fiduciary safe harbor for choosing an annuity provider, including an “in-plan” annuity-type product. Although this provision may not have received as much attention due to the COVID-19 pandemic, plan sponsors and committees should be aware of the new safe harbor option, particularly in light of the upcoming requirement to provide lifetime income disclosures to participants, which is set to become effective later this year (discussed here).

Department of Labor Confirms It Will Not Enforce Controversial “Pecuniary Factors” Rule for ERISA Plan Investments

On March 10, 2021, the Department of Labor’s Employee Benefits Security Administration (EBSA), the agency charged with interpreting and enforcing ERISA, announced that it will not enforce the Trump-era “Financial Factors in Selecting Plan Investments” rule, which has been perceived as potentially discouraging retirement plan fiduciaries from selecting investment alternatives which emphasize environmental, social, and governance factors (commonly referred to as “ESG investments”).

The rule, which was finalized in November 2020 and technically became effective on January 12, 2021, does not prohibit ESG investments. However, it has been widely criticized as fostering a misapprehension that ESG investments may be subjected to a higher degree of fiduciary scrutiny than others. Following the election, EBSA’s announcement of its non-enforcement policy comes as no surprise, as the Biden administration had already identified the rule on its “List of Agency Actions for Review.”

Biden Administration Permits Trump-Era Investment Advice Exemption, Rollover Guidance, to Come Into Effect

The Department of Labor issued a press release on February 12 confirming that Prohibited Transaction Exemption 2020-02, titled “Improving Investment Advice for Workers & Retirees” (the “Exemption”), would go into effect as scheduled. The Exemption was finalized and published by the Trump administration in December 2020, and came into effect on February 16.

The newly available Exemption is intended to fill a void left by the loss of the “Best Interest Contract” or “BIC” Exemption, which was struck down along with the rest of the Obama-era Fiduciary Rule in a March 2018 Fifth Circuit ruling.

DOL Provides (Informal, Non-Binding) Guidance on Missing Participants

On January 12, 2021, the Department of Labor (“DOL”) issued guidance that is intended to help retirement plan fiduciaries meet their ERISA obligations to locate and distribute benefits to missing or nonresponsive participants.

Continue reading “DOL Provides (Informal, Non-Binding) Guidance on Missing Participants”

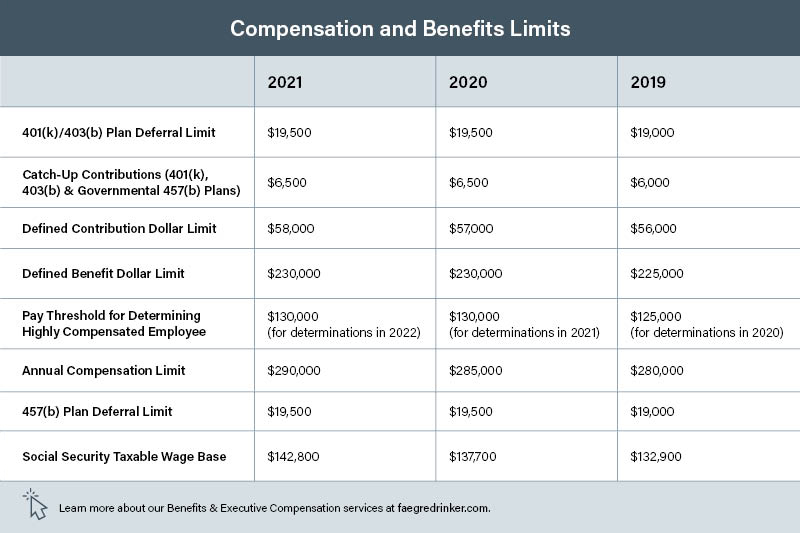

IRS Announces 2021 Dollar Limits for Employee Benefits Plans

The IRS has announced the dollar limits for contributions and benefits in retirement plans and certain deferred compensation plans for 2021. We have compiled a chart summarizing the key limits below, including how they compare with those in the previous year. Plan sponsors should confirm with their recordkeepers that all systems have been updated to reflect the 2021 limits.

Cybersecurity: A Plan Sponsor Obligation

A recently filed lawsuit against a trust company serving as a 401(k) plan trustee, the second of its kind in the last few months, highlights the need for plan sponsor diligence in protecting participant data and accounts in an increasingly electronic world. We only have one side of the story so far, the allegations in the complaint, but the trustee is charged with permitting a thief to get almost $125,000 from the business owner’s account. This was done through phone, email and bank accounts not associated in the trustee’s records with the owner’s account. It took several weeks for the trustee to notify the business owner, and the trustee only did so when it received and prevented a second fraudulent distribution request. The trust company has not yet restored the account.

Rehiring Employees by March 31, 2021 Could Prevent Partial Plan Terminations

The Consolidated Appropriations Act, 2021, enacted on December 27, 2020 (the CAA), includes limited relief pertaining to the partial termination of a qualified retirement plan that may have been inadvertently triggered by employer-initiated severances during the COVID-19 pandemic. Generally, as discussed further in our May 2020 post, the determination as to whether a partial plan termination has occurred depends on the facts and circumstances; however, there is a rebuttable presumption of a partial plan termination if, during the applicable period, the employee turnover rate is at least 20 percent. The employee turnover rate is the number of participating employees who had an employer-initiated severance divided by the total number of participating employees. A partial plan termination triggers 100% vesting for affected participants.

Continue reading “Rehiring Employees by March 31, 2021 Could Prevent Partial Plan Terminations”

PBGC Publishes Final Rule Allowing Simplified Withdrawal Liability Calculations Applicable to Benefit Reductions, Benefit Suspensions and Contributions

On Friday January 8, the Pension Benefit Guaranty Corporation (PBGC) published a final rule that provides multiemployer pension plans with additional methods to help calculate employer withdrawal liability. The rule includes relatively simplified approaches to calculating withdrawal liability that multiemployer plans may choose to use. The rule comes into effect on Friday, January 7, 2022, 30 days after its publication in the Federal Register. The final rule reflects changes based on several comments made to the proposed rule that was published on February 6, 2019.

The Employee Retirement Income Security Act (ERISA) charges the PBGC with oversight of multiemployer pension plans, including employer withdrawal liability. Multiemployer plans and their actuaries do not have free reign to calculate withdrawal liability as they see fit. Rather, they must follow the provisions and approved methods set forth in ERISA and as published by the PBGC. The new rule stems from amendments to the ERISA funding rules implemented by Congress in 2006 under the Pension Protection Act (“PPA”) and in 2014 under the Multiemployer Pension Reform Act (“MPRA”). The funding rules permitted financially distressed multiemployer plans to reduce adjustable benefits, suspend a portion of nonforfeitable benefits, and impose contribution increases and surcharges for underfunded plans. These funding rules clarified whether plans could take these changes into account when determining withdrawal liability and instructed the PBGC to draft simplified methods to do so.

IRS Extends Temporary Relief from “Physical Presence” Requirement for Certain Retirement Plan Elections

On December 22, 2020, the Internal Revenue Service (“IRS”) issued an advance version of Notice 2021-03 (the “Extension Notice”) to extend the temporary relief from the “physical presence” requirement for participant elections under retirement plans that was previously granted in Notice 2020-42 (the “Relief Notice”).