As noted in several recent blog posts, the year-end Consolidated Appropriations Act (CAA) included a number of employee benefits-related changes. One set of changes represents an effort to further strengthen protections under the Mental Health Parity and Addiction Equity Act (MHPAEA). These new provisions will require group health plans and health insurance issuers (collectively, “group health plans”) that provide both medical and surgical (M/S) benefits and mental health or substance use disorder (MH/SUD) benefits and that impose nonquantitative treatment limitations (NQTL) on MH/SUD benefits to perform comparative analyses to demonstrate compliance with mental health parity requirements. Plans will also be required to provide that comparative information to the DOL, HHS or applicable State authority upon request (DOL for ERISA-governed group health plans). These new requirements go into effect February 10, 2021 (45 days after enactment of the CAA).

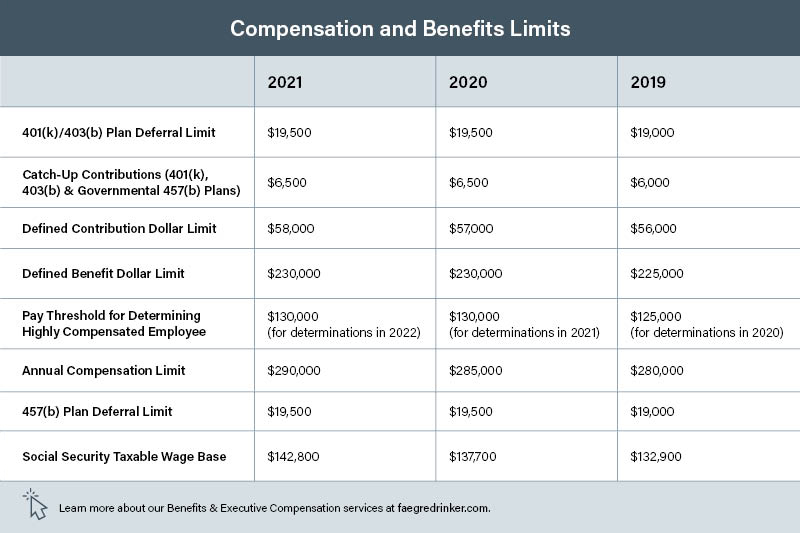

IRS Announces 2021 Dollar Limits for Employee Benefits Plans

The IRS has announced the dollar limits for contributions and benefits in retirement plans and certain deferred compensation plans for 2021. We have compiled a chart summarizing the key limits below, including how they compare with those in the previous year. Plan sponsors should confirm with their recordkeepers that all systems have been updated to reflect the 2021 limits.

Cybersecurity: A Plan Sponsor Obligation

A recently filed lawsuit against a trust company serving as a 401(k) plan trustee, the second of its kind in the last few months, highlights the need for plan sponsor diligence in protecting participant data and accounts in an increasingly electronic world. We only have one side of the story so far, the allegations in the complaint, but the trustee is charged with permitting a thief to get almost $125,000 from the business owner’s account. This was done through phone, email and bank accounts not associated in the trustee’s records with the owner’s account. It took several weeks for the trustee to notify the business owner, and the trustee only did so when it received and prevented a second fraudulent distribution request. The trust company has not yet restored the account.

Fee Disclosure Rules Will Soon Apply to Group Health Plans

Buried in the year-end Consolidated Appropriations Act (CAA) is a provision that requires group health plan brokers and consultants to make comprehensive fee disclosures similar to those that apply to retirement plans. As discussed further below, the new fee-disclosure requirements will result in additional compliance obligations for group health plan sponsors, brokers, and consultants, starting in December 2021.

As background, ERISA generally prohibits transactions between an ERISA plan and a party-in-interest, such as a service provider to the plan. However, a statutory exemption (known as the ERISA 408(b)(2) exemption) allows such transactions so long as the plan pays only reasonable compensation to a party-in-interest to provide necessary services to the plan. In 2012, the Department of Labor (DOL) issued regulations under which the ERISA 408(b)(2) exemption is available for a retirement plan only if a covered service provider makes a number of fee and service disclosures to the plan’s fiduciary to enable the fiduciary to make a determination as to whether the fees are reasonable. These are generally referred to as the 408(b)(2) fee disclosures. The DOL regulations implementing this fee-disclosure requirement specifically omit health and welfare plans.

Continue reading “Fee Disclosure Rules Will Soon Apply to Group Health Plans”

Rehiring Employees by March 31, 2021 Could Prevent Partial Plan Terminations

The Consolidated Appropriations Act, 2021, enacted on December 27, 2020 (the CAA), includes limited relief pertaining to the partial termination of a qualified retirement plan that may have been inadvertently triggered by employer-initiated severances during the COVID-19 pandemic. Generally, as discussed further in our May 2020 post, the determination as to whether a partial plan termination has occurred depends on the facts and circumstances; however, there is a rebuttable presumption of a partial plan termination if, during the applicable period, the employee turnover rate is at least 20 percent. The employee turnover rate is the number of participating employees who had an employer-initiated severance divided by the total number of participating employees. A partial plan termination triggers 100% vesting for affected participants.

Continue reading “Rehiring Employees by March 31, 2021 Could Prevent Partial Plan Terminations”

Flexible Spending Account Relief in the Consolidated Appropriations Act of 2021

As noted in our prior blog post, the Consolidated Appropriations Act, 2021 (the Act) includes several types of relief for flexible spending accounts (FSAs), impacting both health FSAs and dependent care FSAs. The FSA relief provisions in the Act address a concern raised frequently by employees and employers in 2020 — must employees forfeit their remaining 2020 FSA funds based on the rules that normally apply to FSAs under the Internal Revenue Code (the Code), given that, due to the COVID-19 pandemic, many employees’ actual 2020 health and dependent care expenses were significantly less than employees anticipated when they elected FSA coverage for 2020?

Continue reading “Flexible Spending Account Relief in the Consolidated Appropriations Act of 2021”

PBGC Publishes Final Rule Allowing Simplified Withdrawal Liability Calculations Applicable to Benefit Reductions, Benefit Suspensions and Contributions

On Friday January 8, the Pension Benefit Guaranty Corporation (PBGC) published a final rule that provides multiemployer pension plans with additional methods to help calculate employer withdrawal liability. The rule includes relatively simplified approaches to calculating withdrawal liability that multiemployer plans may choose to use. The rule comes into effect on Friday, January 7, 2022, 30 days after its publication in the Federal Register. The final rule reflects changes based on several comments made to the proposed rule that was published on February 6, 2019.

The Employee Retirement Income Security Act (ERISA) charges the PBGC with oversight of multiemployer pension plans, including employer withdrawal liability. Multiemployer plans and their actuaries do not have free reign to calculate withdrawal liability as they see fit. Rather, they must follow the provisions and approved methods set forth in ERISA and as published by the PBGC. The new rule stems from amendments to the ERISA funding rules implemented by Congress in 2006 under the Pension Protection Act (“PPA”) and in 2014 under the Multiemployer Pension Reform Act (“MPRA”). The funding rules permitted financially distressed multiemployer plans to reduce adjustable benefits, suspend a portion of nonforfeitable benefits, and impose contribution increases and surcharges for underfunded plans. These funding rules clarified whether plans could take these changes into account when determining withdrawal liability and instructed the PBGC to draft simplified methods to do so.

FSA Relief and Significant New Health Plan Requirements Included in Consolidated Appropriations Act of 2021

The Consolidated Appropriations Act of 2021 (Act), enacted on December 27, 2020, contains a number of provisions that may impact the design and administration of employer-sponsored group health plans and flexible spending account (FSA) benefits. Below, we summarize the primary provisions. In the days and weeks ahead, Spotlight on Benefits will provide a series of blog posts that will address the provisions in more detail. We encourage health and FSA plan sponsors to review the blog posts and consider the preparations needed to comply with applicable changes in the law, including coordinating with insurers and third-party administrators, the various effective dates, and whether plan sponsors will have to amend their health plans or FSA plans to implement any applicable changes.

Section 162(m) Final Regulations Clarify Grandfathering Rules to Compensation Payable under Account Balance and Nonaccount Balance Nonqualified Plans

Pubic companies that sponsor nonqualified deferred compensation plans with grandfathered benefits will want to be aware of helpful payment guidance in the Internal Revenue Code Section 162(m) final regulations. The final regulations, which were published in the Federal Register on December 30, 2020, implement amendments made to Section 162(m) by the Tax Cuts and Jobs Act (TCJA). The regulations adopt the Section 162(m) proposed regulations issued on December 20, 2019, with certain modifications.

IRS Extends Temporary Relief from “Physical Presence” Requirement for Certain Retirement Plan Elections

On December 22, 2020, the Internal Revenue Service (“IRS”) issued an advance version of Notice 2021-03 (the “Extension Notice”) to extend the temporary relief from the “physical presence” requirement for participant elections under retirement plans that was previously granted in Notice 2020-42 (the “Relief Notice”).